Dolomite Mining Market Size, Growth & Forecast 2025-2033

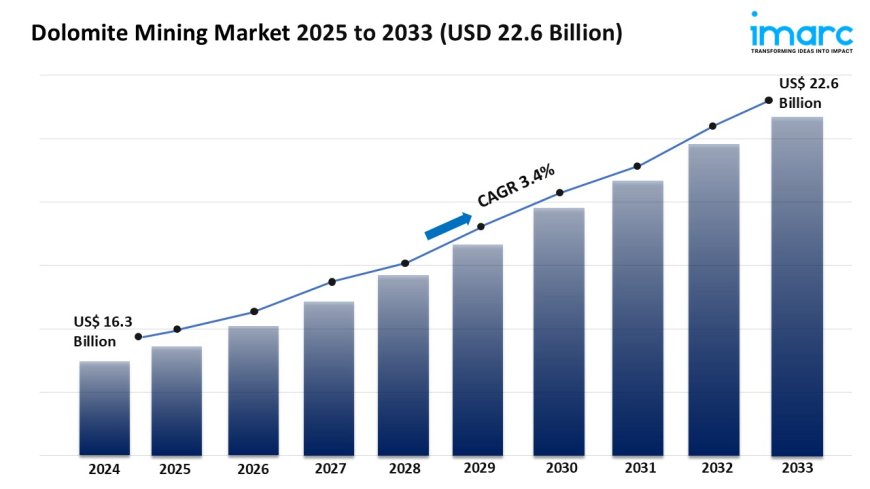

The global dolomite mining market size reached USD 16.3 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 22.6 Billion by 2033, exhibiting a growth rate (CAGR) of 3.4% during 2025-2033.

Market Overview:

The dolomite mining market is experiencing rapid growth, driven by booming construction and infrastructure demand, rising steel and refractory industry needs, and growing agricultural and environmental applications. According to IMARC Group's latest research publication, "Dolomite Mining Market Report by Type (Calcined, Sintered), Application (Construction, Agriculture, Animal Feed, Ceramics and Glass, Iron and Steel, Plastic, and Others), and Region 2025-2033",theglobal dolomite mining marketsize reachedUSD16.3Billionin2024. Looking forward, IMARC Group expects the market to reachUSD22.6Billionby2033, exhibiting a growth rate(CAGR) of3.4%during2025-2033.

This detailed analysis primarily encompasses industry size, business trends, market share, key growth factors, and regional forecasts. The report offers a comprehensive overview and integrates research findings, market assessments, and data from different sources. It also includes pivotal market dynamics like drivers and challenges, while also highlighting growth opportunities, financial insights, technological improvements, emerging trends, and innovations. Besides this, the report provides regional market evaluation, along with a competitive landscape analysis.

Download a sample PDF of this report: https://www.imarcgroup.com/dolomite-mining-market/requestsample

Our report includes:

- Market Dynamics

- Market Trends and Market Outlook

- Competitive Analysis

- Industry Segmentation

- Strategic Recommendations

Growth Factors in the Dolomite Mining Market

- Booming Construction and Infrastructure Demand

The global construction industrys rapid growth is a major driver for dolomite mining. Dolomite is widely used as an aggregate in concrete and road construction due to its durability and strength. For instance, Oxford Economics reports that global construction output reached $9.7 trillion recently, with significant demand for materials like dolomite in emerging markets such as Asia-Pacific. This region alone accounts for nearly 40% of the global dolomite market share, led by infrastructure projects in China and India. Companies like JFE Mineral and CEMEX are ramping up production to meet this demand, with CEMEX recently expanding its quarrying operations in Asia. Government initiatives, like Indias infrastructure push under the National Infrastructure Pipeline, further boost dolomite consumption for roads and buildings, ensuring steady market growth.

- Rising Steel and Refractory Industry Needs

Dolomites role as a fluxing agent and refractory material fuels its demand in the steel industry. With global steel production hitting around 1.9 billion tons annually, dolomite is critical for lining furnaces and improving steel quality. In Asia, steel plants have reported a 7% increase in high-purity dolomite use, as noted by Coherent Market Insights. Companies like RHI Magnesita are investing heavily in dolomite-based refractory solutions to support this sector. Government policies, such as Chinas steel production quotas to balance environmental concerns, indirectly drive demand for high-quality dolomite. Additionally, dolomites magnesium content is vital for specialty steel alloys, and firms like Essel Mining are scaling up operations to supply this growing market, particularly in industrial hubs across Asia and Europe.

- Growing Agricultural and Environmental Applications

Dolomites use in agriculture and environmental solutions is surging due to its magnesium and calcium content. Its widely applied as a soil conditioner to neutralize pH and boost crop yields, with demand rising in regions like Asia-Pacific, where farming supports millions. For example, Omya Group reports increased dolomite sales for agricultural lime, especially in Indias fertile plains. Environmentally, dolomite aids in water treatment and carbon capture, aligning with global sustainability goals. Government schemes, like the EUs Green Deal, promote dolomite in eco-friendly applications, such as flue gas desulfurization. The market for these applications is expanding, with companies like Sibelco innovating dolomite-based products for cleaner production processes, driving growth in regions prioritizing sustainable industrial practices.

Key Trends in the Dolomite Mining Market

- Shift Toward Sustainable Mining Practices

Sustainability is reshaping dolomite mining as companies adopt eco-friendly practices to meet regulatory and consumer demands. For instance, Nordkalk Corporation has implemented energy-efficient quarrying techniques, reducing emissions by 15% in its European operations. Governments, like those in the EU, enforce stricter environmental standards, pushing firms to invest in green technologies. Real-world applications include using dolomite in carbon capture systems, with pilot projects in Asia showing a 10% reduction in industrial CO2 emissions. Miners are also recycling waste dolomite for construction aggregates, minimizing environmental impact. This trend is gaining traction, especially in Asia-Pacific, where rapid industrialization meets growing pressure for sustainability, encouraging companies like Lhoist Group to innovate in waste management and low-carbon extraction methods.

- Technological Advancements in Processing

New technologies are transforming dolomite mining by improving efficiency and product quality. Automated crushing and sizing systems, adopted by firms like Imerys S.A., have boosted production output by 20% in some facilities. Hyperspectral satellite mapping, as highlighted by Farmonaut, is revolutionizing dolomite deposit identification, enabling precise extraction in regions like North America. These advancements reduce costs and enhance resource recovery, with real-world applications in high-purity dolomite for glass manufacturing. For example, Arihant Minchem uses advanced calcination techniques to supply consistent dolomite for industrial clients. Government support, such as Canadas mining innovation grants, fuels these upgrades, helping companies stay competitive. This trend is critical as demand for specialized dolomite grows in industries like ceramics and chemicals.

- Expansion into Niche Applications

Dolomite is finding new uses in niche markets like pharmaceuticals and green technologies, broadening its market scope. In pharmaceuticals, dolomites magnesium content is used in supplements, with global sales of magnesium-based products rising by 12% annually, per industry reports. Companies like Beihei Group are exploring dolomite in medical-grade applications, tapping into health-focused markets. In green tech, dolomite is used in energy storage systems, with pilot projects in Europe testing dolomite-based batteries. Government incentives, such as the U.S. Department of Energys clean tech funding, support these innovations. Real-world examples include Carmeuse supplying dolomite for soil remediation in agricultural trials, showing a 15% improvement in soil health. This trend reflects dolomites versatility, driving demand in diverse, high-growth sectors.

Leading Companies Operating in the Dolomite Mining Industry:

- Calcinor

- Carmeuse

- E. Dillon & Company

- Essel Mining & Industries Limited (Aditya Birla Group)

- Imerys

- JFE Mineral Co. Ltd. (JFE Steel)

- Lhoist

- Omya AG

- RHI Magnesita GmbH and Sibelco

Dolomite Mining Market Report Segmentation:

By Type:

- Calcined

- Sintered

Sintered dolomite dominates the market, recognized for its superior properties and essential role in industrial applications like steelmaking and cement production.

By Application:

- Construction

- Agriculture

- Animal Feed

- Ceramics and Glass

- Iron and Steel

- Plastic

- Others

Construction holds the largest market share, driven by dolomite's vital use in concrete, asphalt, and cement production, bolstered by rapid urbanization and infrastructure development.

Regional Insights:

- North America (United States, Canada)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

North America leads the dolomite mining market, accounting for the largest share, supported by strong demand and established industrial activities in the region.

Research Methodology:

The report employs acomprehensive research methodology, combiningprimary and secondary data sourcesto validate findings. It includesmarket assessments, surveys, expert opinions, and data triangulation techniquesto ensureaccuracy and reliability.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the worlds most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145